Altiplano Design Insights

Exploring the beauty and creativity of design in everyday life.

KYC Verification: The Secret Ingredient to Hassle-Free Withdrawals

Unlock hassle-free withdrawals! Discover how KYC verification is the secret ingredient to smooth and secure transactions.

Understanding KYC Verification: Why It's Essential for Smooth Transactions

KYC Verification, or Know Your Customer verification, is an essential process in various industries, particularly in banking, finance, and cryptocurrency. This procedure involves verifying the identity of clients to ensure they are who they claim to be. With the increasing rates of fraud and money laundering activities, KYC has become a crucial component for businesses aiming to protect themselves and their customers. By implementing robust KYC procedures, companies can enhance the integrity of financial transactions and build trust with their client base.

The significance of KYC verification extends beyond mere compliance; it’s integral to ensuring smooth transactions. By confirming a customer's identity, businesses can reduce the risk of chargebacks and fraudulent activities, leading to a more secure transaction environment. Additionally, KYC helps businesses comply with legal requirements and industry regulations, thereby avoiding potential legal issues or fines. Ultimately, thorough KYC verification processes can streamline operations, improve customer experiences, and foster long-term loyalty.

Don't miss out on the latest offers! Use the rainbet promo code to get exclusive bonuses and boosts on your bets.

Top 5 Benefits of KYC Verification for Hassle-Free Withdrawals

Know Your Customer (KYC) verification is a vital process that offers significant benefits for both users and service providers, particularly in the context of financial transactions. One of the primary advantages is the enhanced security it provides, safeguarding users' accounts from fraud and unauthorized activities. When customers undergo KYC, they are required to verify their identity through official documents, making it difficult for malicious actors to exploit vulnerabilities. This not only protects individual users but also fosters a safer environment for the entire platform, ensuring a hassle-free withdrawal process.

Secondly, implementing KYC verification helps in streamlining the withdrawal process, offering a smoother user experience. With pre-verified identities, platforms can significantly reduce the time and effort involved in transaction approvals. This means users can enjoy quicker access to their funds without the frustrating delays often caused by the need for additional identity checks. Overall, adopting KYC protocols not only enhances user confidence but also promotes a more efficient operational framework for financial transactions.

KYC Verification FAQs: Everything You Need to Know for Easy Withdrawals

Know Your Customer (KYC) verification is a crucial process that financial institutions and online platforms use to validate the identity of their users. If you're wondering how KYC affects your ability to make withdrawals, you've come to the right place. Here are some frequently asked questions to help you understand the importance of KYC verification:

- What is KYC verification? - KYC involves collecting and verifying personal information such as your name, address, and identification documents to ensure that you are who you claim to be.

- Why is KYC necessary? - This process helps prevent fraud, money laundering, and other illicit activities, ensuring a safer environment for all users.

Understanding the KYC verification process can make your experience smoother and help you avoid potential withdrawal issues. Here are some additional FAQs that may be beneficial:

- How long does KYC verification take? - The duration can vary based on the platform, but typically ranges from a few minutes to several days.

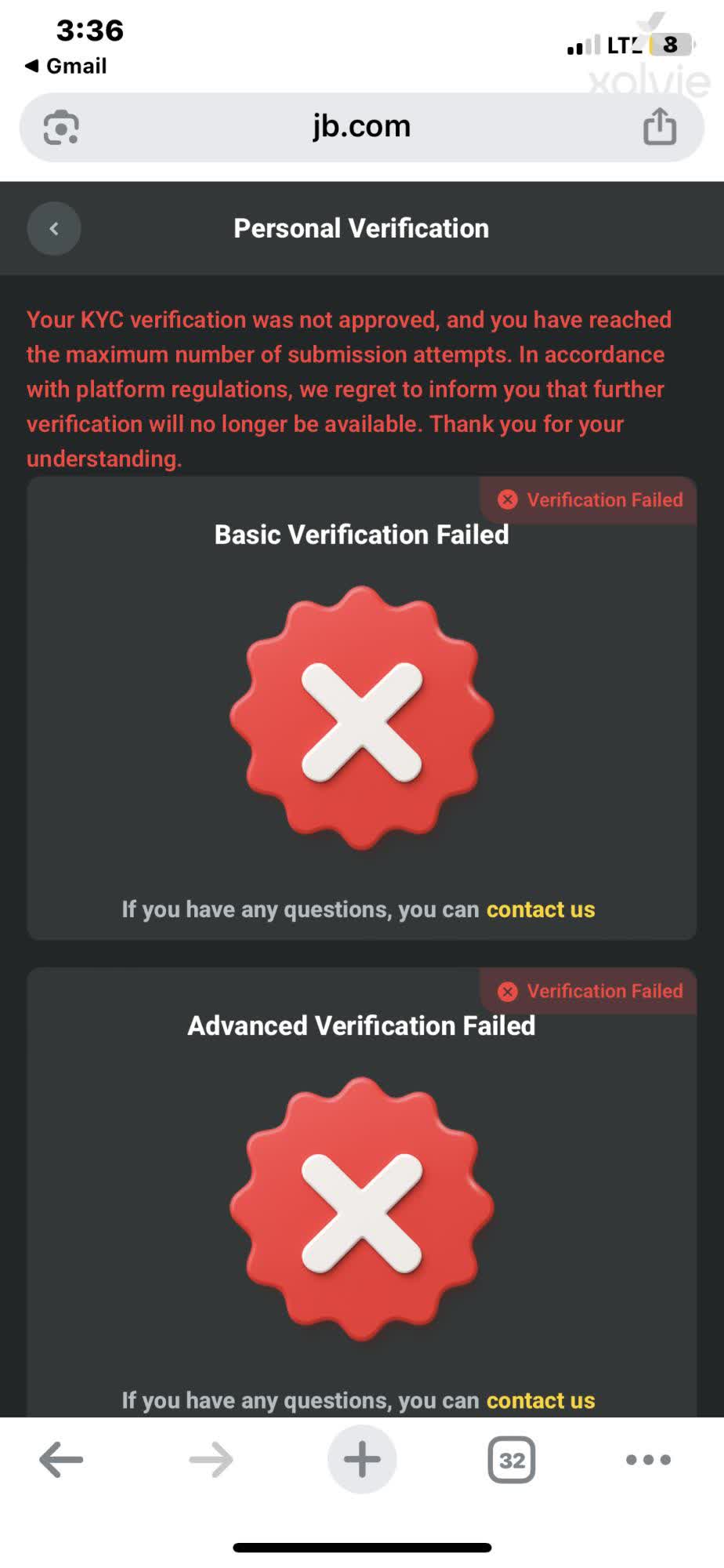

- What happens if I don't complete KYC? - Failing to complete the KYC process could result in restrictions on your account, including the inability to withdraw funds.