Altiplano Design Insights

Exploring the beauty and creativity of design in everyday life.

Digital Asset Trading: The New Age of Fortune and Folly

Discover the thrilling world of digital asset trading—where fortunes are made and lost in an instant. Dive into the new age of investment today!

Understanding Digital Assets: A Beginner's Guide to Trading

In today’s digital age, understanding digital assets is crucial for anyone looking to participate in trading. Digital assets can be broadly defined as any asset that exists in a digital form and includes cryptocurrencies, digital tokens, and more. These assets operate on decentralized networks and can provide unique investment opportunities. Beginners should first familiarize themselves with the core concepts of blockchain technology, as it underpins most digital assets, ensuring transparency and security in transactions.

When it comes to trading digital assets, there are several key factors to consider. First, choose a reliable exchange platform to buy and sell your assets. It is important to conduct thorough research to find an exchange that offers strong security measures, user-friendly interfaces, and competitive fees. Additionally, beginners should look into different trading strategies, such as day trading or HODLing, to determine which approach aligns with their risk tolerance and investment goals. Remember, trading can be volatile, so it’s essential to stay informed and invest wisely.

Counter-Strike is a popular tactical first-person shooter game where players compete in teams to complete objectives such as bomb defusal or hostage rescue. The game has a rich history and has evolved with versions like CS:GO, attracting millions of players worldwide. For those looking to enhance their gameplay experience, using a daddyskins promo code can provide exciting opportunities in the game.

The Risks and Rewards of Digital Asset Investment

Investing in digital assets, such as cryptocurrencies and NFTs, has gained tremendous traction over the last few years. However, this burgeoning market is not without its risks. One major concern is the inherent volatility of digital assets, which can lead to significant gains or losses in a very short time frame. Consider the following risks:

- Market fluctuation: Prices can change drastically based on market sentiment.

- Lack of regulation: The absence of a governing body increases the potential for fraud.

- Technological vulnerabilities: Hacks and security breaches can lead to loss of assets.

Despite the risks, the rewards of investing in digital assets can be enticing. Many investors have seen remarkable returns, making digital currencies and collectibles lucrative opportunities. Benefits of investing in digital assets include:

- High potential returns: Early investors in Bitcoin and Ethereum, for instance, reaped substantial profits.

- Diverse portfolio: Incorporating digital assets can enhance overall portfolio diversification.

- Innovation and growth: The digital asset landscape continues to evolve, offering new investment avenues.

Is Digital Asset Trading the Future of Wealth Creation?

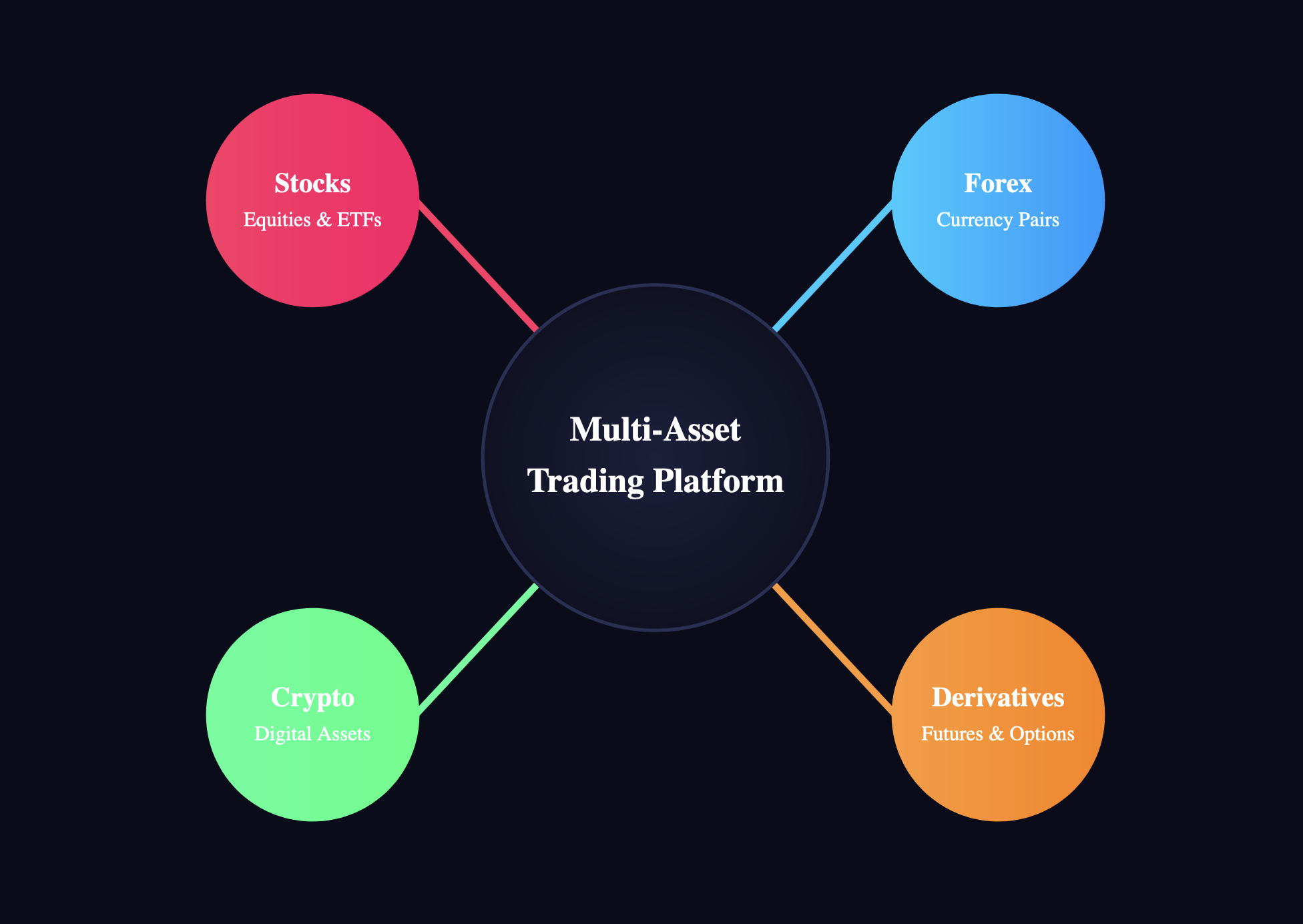

The rise of digital asset trading has sparked significant interest among investors and financial analysts alike, leading many to speculate whether it represents the future of wealth creation. Unlike traditional assets such as stocks and bonds, digital assets, including cryptocurrencies and tokenized assets, offer unique advantages like decentralization and increased accessibility. With nearly 300 million users engaged in cryptocurrencies globally, there's a palpable buzz around the potential for substantial returns on investment in this relatively nascent market.

Moreover, the evolution of blockchain technology and regulatory adjustments are paving the way for digital asset trading to become more mainstream. As traditional financial institutions begin to embrace cryptocurrencies and various forms of tokenization, the potential for wealth creation grows exponentially. This shift could open new avenues for diversification in investment portfolios, allowing individuals to take advantage of both established and emerging digital assets. Ultimately, the question remains: Are you ready to adapt your investment strategy to capitalize on the future of wealth creation?