Altiplano Design Insights

Exploring the beauty and creativity of design in everyday life.

Navigating the Car Jungle: Secrets to Finding Your Perfect Ride

Unlock the secrets to finding your dream car! Navigate the car jungle with expert tips and make your next ride the perfect one.

5 Essential Tips for First-Time Car Buyers

Buying your first car can be an exciting yet overwhelming experience. To navigate this journey successfully, it's essential to arm yourself with knowledge. Here are 5 essential tips for first-time car buyers that will help you make informed decisions and avoid common pitfalls. First, set a clear budget. Consider not only the purchase price but also additional costs such as insurance, maintenance, and fuel. This comprehensive budgeting can prevent financial strain later on.

Secondly, do your research. Investigate various makes and models to find one that suits your lifestyle and needs. Utilize online reviews and comparison tools to identify the best options. Thirdly, consider purchasing a certified pre-owned vehicle to save money while still receiving a reliable car. Fourth, take your time during the test drive; it’s the best way to gauge comfort and performance. Lastly, don't forget to negotiate the price—dealerships often expect it, so don't shy away from discussing terms to ensure you get a fair deal.

Understanding the Different Types of Car Financing: What You Need to Know

When it comes to purchasing a vehicle, understanding the different types of car financing is crucial for making an informed decision. The most common options include traditional bank loans, credit union loans, and dealership financing. Each option has its unique features, interest rates, and repayment terms that can significantly impact your budget. For instance, traditional bank loans typically offer competitive interest rates and flexible terms, while credit unions may provide better rates for their members. Dealership financing, on the other hand, can be convenient but often comes with higher interest rates.

Another type of car financing to consider is lease financing, which allows you to drive a vehicle for a set period while making monthly payments. At the end of the lease term, you have the option to buy the vehicle or return it. It's essential to evaluate the advantages and disadvantages of leasing versus buying. If you prefer driving new cars regularly without the commitment of ownership, leasing might be the right choice. However, if you're looking for long-term value and plan on keeping your car for several years, purchasing through a more traditional financing method may be the better route.

How to Evaluate a Used Car: A Step-by-Step Guide

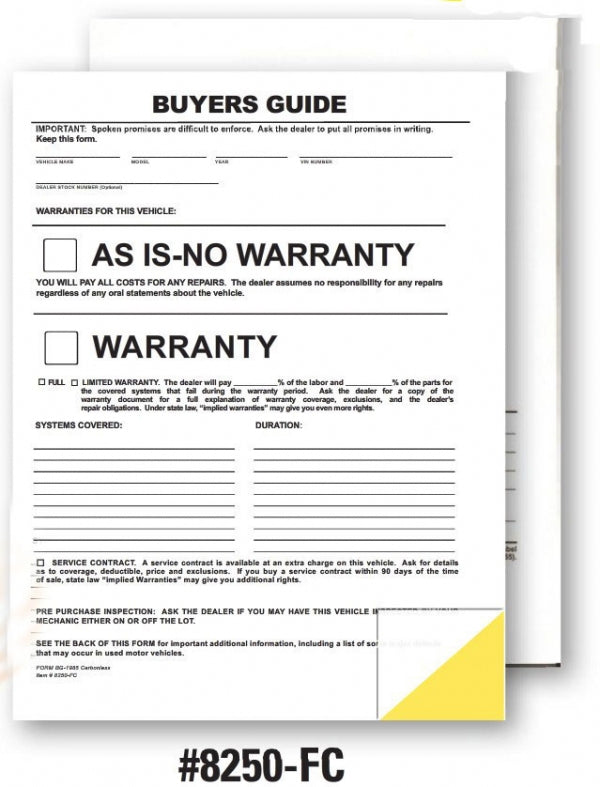

When it comes to evaluating a used car, taking a systematic approach can save you time and help you make an informed decision. Start by creating a checklist that includes important factors such as vehicle history, mileage, and maintenance records. A thorough inspection of the car's exterior and interior is also crucial. Check for signs of rust, dents, or previous accidents. Additionally, test driving the vehicle allows you to get a feel for its handling and performance, so you can assess whether it meets your expectations.

After compiling your initial findings, it’s essential to research the market value of the car you’re considering. Websites like Kelley Blue Book or Edmunds can provide valuable insights on pricing. You should also get an independent mechanic to inspect the vehicle for any hidden issues that may not be immediately apparent. Finally, once you're comfortable with the condition and price, be sure to negotiate, as this could save you a significant amount. By following these steps to evaluate a used car, you can enhance your purchasing experience and ensure you drive away happy.