Altiplano Design Insights

Exploring the beauty and creativity of design in everyday life.

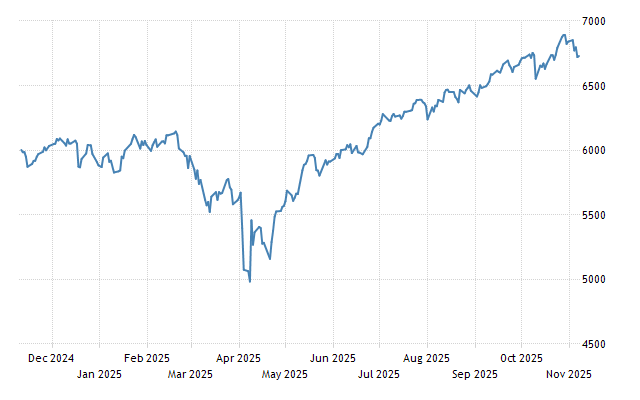

The Stock Market: A Rollercoaster Ride for Your Wallet

Discover the thrilling ups and downs of investing in the stock market! Buckle up for a financial adventure that could boost your wallet!

Understanding Market Fluctuations: What Drives Stock Prices Up and Down?

Understanding market fluctuations is crucial for investors seeking to navigate the often volatile world of stock prices. Several factors drive these fluctuations, including economic indicators, investor sentiment, and unexpected global events. Key economic indicators, such as GDP growth, unemployment rates, and consumer spending, provide insights into the overall health of the economy. When these indicators show strong performance, investor confidence typically rises, leading to increased buying pressure and elevated stock prices. Conversely, poor economic data can trigger panic selling, causing stock prices to drop.

Another significant driver of stock price fluctuations is investor sentiment, which reflects the overall mood of the market. Sentiment can be influenced by news reports, social media trends, and economic forecasts. For instance, positive news about a company's earnings can generate enthusiasm, prompting more investors to purchase shares, thereby driving prices up. Additionally, geopolitical events and market speculation can introduce uncertainty, further impacting investor behavior. Understanding these dynamics is essential for anyone looking to make informed investment decisions in a fluctuating market.

Surviving the Market's Ups and Downs: Investment Strategies for Uncertain Times

In today's volatile economic landscape, surviving the market's ups and downs requires a strategic approach to investing. Market fluctuations can evoke fear and uncertainty, but by diversifying your portfolio, you can mitigate risks. Consider allocating your investments across multiple asset classes such as stocks, bonds, and real estate. This not only spreads your risk but also increases the likelihood of capitalizing on different market conditions. Additionally, maintaining a long-term perspective can help you ride out the storms, as historically, markets tend to recover from downturns over time.

Another effective strategy during uncertain times is to focus on fundamentals. Investing in companies with strong balance sheets, consistent cash flow, and resilient business models can provide a layer of security. Moreover, consider implementing a dollar-cost averaging approach, which involves regularly investing a fixed amount regardless of market conditions. This helps reduce the impact of volatility on your overall investment and can lead to better returns over time. Ultimately, by combining these strategies, you can better position yourself to thrive amidst market uncertainty.

Is Investing in Stocks Worth the Risk? Analyzing Potential Returns vs. Volatility

Investing in stocks has long been seen as a double-edged sword; it offers the potential for high returns but also comes with significant risks. Volatility, defined as the degree of variation in trading prices, can make the stock market a daunting place for new investors. However, understanding the potential returns is crucial for making informed decisions. Over the long term, stocks have historically outperformed other investment vehicles like bonds or savings accounts. For instance, the average annual return of the S&P 500, a broad index of U.S. stocks, has been around 10% over the last century, showcasing the high-reward nature of stock investments.

That said, the risk associated with stock investing should not be understated. Market fluctuations, economic downturns, and company-specific events can lead to periods of significant loss. Potential investors must weigh their risk tolerance against the goal of achieving strong financial returns. As a guideline, experts often recommend a diversified portfolio to mitigate the effects of volatility, allowing investors to capture gains while safeguarding against losses. In conclusion, while investing in stocks can be worthwhile, it requires a balanced approach that considers both returns and inherent risks.