Altiplano Design Insights

Exploring the beauty and creativity of design in everyday life.

Save Big Bucks: Auto Insurance Discounts That Actually Work

Unlock hidden savings! Discover auto insurance discounts that really work and keep your hard-earned cash in your pocket. Save big now!

Unlocking the Secrets to Maximizing Your Auto Insurance Discounts

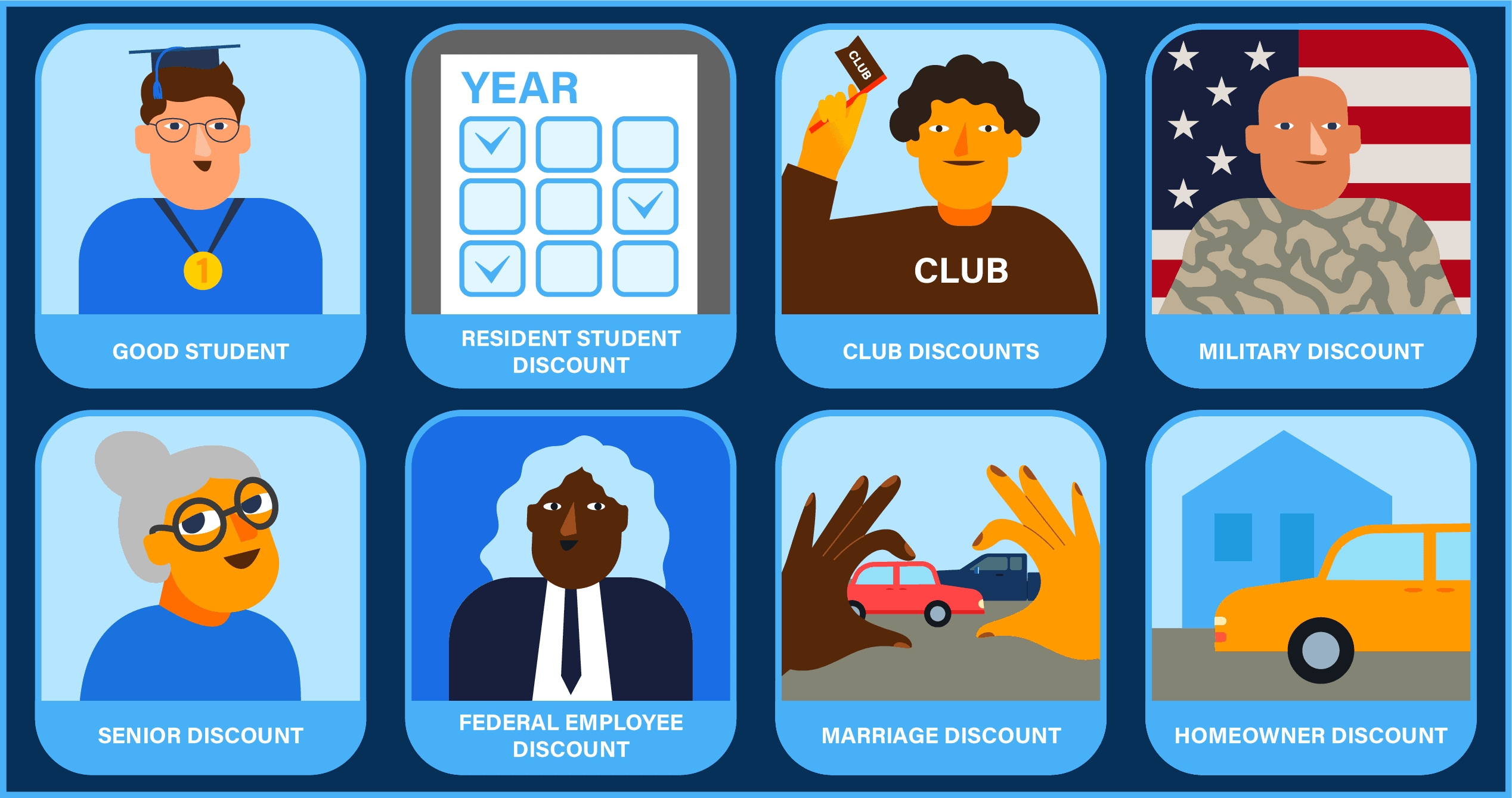

When it comes to maximizing your auto insurance discounts, understanding the various types of discounts available is crucial. Many insurance companies offer a wide range of incentives that can significantly lower your premium. Some common discounts include:

- Safe driver discounts for maintaining a clean driving record

- Good student discounts for young drivers who achieve high academic grades

- Bundling discounts when you purchase multiple policies from the same insurer

- Low mileage discounts for those who rarely use their vehicle

By researching and inquiring about these discounts, you can ensure that you're taking full advantage of the savings available to you.

Additionally, maximizing your auto insurance discounts often involves making simple lifestyle changes. For instance, consider taking a defensive driving course; many insurers reward drivers who complete such programs with additional discounts. Maintaining a good credit score can also lead to lower premiums, as many companies factor creditworthiness into their pricing models. Finally, don’t hesitate to shop around and compare quotes from different insurance providers. Regularly reviewing your policy can help you stay informed about new discounts that may apply to your situation, ensuring you always get the best rate available.

Top 5 Little-Known Discounts That Could Save You Money on Auto Insurance

When it comes to saving money on auto insurance, many consumers are unaware of the various discounts that can significantly reduce their premiums. Here are the top five little-known discounts that could save you money:

- Low Mileage Discount: If you drive less than a certain number of miles each year, you might qualify for a low mileage discount. This reflects the reduced risk of accidents for drivers who spend less time on the road.

- Occupational Discounts: Certain professions may be eligible for discounts due to lower accident rates within their occupations. It's worth asking your insurer if your job provides any savings.

- Good Student Discount: Young drivers who maintain a strong GPA may qualify for discounts, encouraging academic excellence while also rewarding responsible driving.

- Bundling Discounts: By combining your auto insurance with other policies, such as homeowners or renters insurance, you can often enjoy a bundled discount, resulting in substantial savings.

- Defensive Driving Course Discount: Completing a defensive driving course not only enhances your driving skills but can also yield a discount on your premium as insurers recognize the reduced risk associated with educated drivers.

Are You Missing Out? Essential Questions to Ask Your Auto Insurance Provider About Discounts

When evaluating your auto insurance policy, it's essential to explore all potential savings. Discounts can significantly reduce your premium, and asking the right questions can help you uncover opportunities you might be missing. Start by asking your provider about common discount categories such as multi-policy discounts for bundling your auto insurance with home or renters insurance, or safe driver discounts for maintaining a clean driving record. Additionally, inquire about discounts related to your vehicle, such as low mileage or anti-theft device rebates that could apply to your policy.

Furthermore, consider asking about student, military, or professional discounts, which could provide even more savings based on your status or occupation. Don't forget to inquire about the possibility of lower rates for completing a defensive driving course or using telematics devices that monitor your driving habits. Evaluating all these aspects can help you maximize your savings, ensuring you don't miss out on valuable discounts that could lower your auto insurance costs significantly.